Strategic Consulting carries out consulting specialized in business risks such as business reproduction, the financing.

SERVICE

HOME > Service > Financing support service

Financing support service

We reform the daily work process and management through proposing effective corporate, business and finance strategies to companies faced with financial challenges and dwindling growth. We increase your enterprise value and provide support directly or indirectly through financial or crowd-funding.

Financing support service

Financial institutions have a certain way of thinking and behaviors.

By looking at the behaviors of financial institutions, we act with great foresight to make quick funding possible and support growth of your business.

Banks are not interested in mortgages or transaction histories.

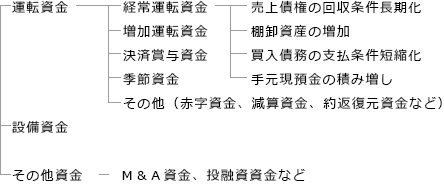

A sound business strategy with high future prospects is the key to get a bank loan approved. Neither the availability of mortgages nor past transaction histories have any influence on creditworthiness. Businesses with low bankruptcy risk and high future prospects are more likely to get a loan approved. Banks are interested in companies with high growth potential and interesting business plans. After the company has applied for a loan, the best loan program will be proposed amongst 4 different types.

?

<Kind of the financing>

Bill Discounting

The company bills are bought by the bank. Bill discounting is optimal for short-term borrowing because settlement period is short.

Promissory Note

The company draws a promissory note and the bank lends money to the company. This type of loan is simple and convenient because of cheap stamp taxes but financing period is within 1 year.

Overdraft

With its "overdraft contract", the company is allowed withdrawing money even when the account has no funds in it. An overdraft is ideal for long-term financing.

Term Loan

Term loans are set for a long period of time. The company fills out a form called "loan agreement" and sets the details about amount, date of borrowing, repayment method, interest rate and other conditions.

?

<The Financial Institution's "Request for Decision" Screening Process Flowchart>

- Proposal for approval request

- →

- Section chief/assistant branch chief

- →

- District manager

(if request for decision is processed in the headquarter: credit officer → senior credit officer → credit manager) - →

- Financing

The key to get a loan approved is to provide detailed information about your business situation.

?

<Point of the financing judgment>

| Loan Funding Process | Details | Example/Type |

|---|---|---|

| Funding (purpose of loan) | How the loan is used |  |

| Repayment (source of repayment) | How the loan is repaid | Money planning (repayment plan), repayment condition, if a repayment is realistic with the current business plan |

| Mortgage | What kind of measures are taken if repayment fails | Availability of mortgages and guarantee (if funding is possible without mortgages or without guarantee) |

| Advantage | What are the advantages for the financial institute in funding the business | Increase of account balance, transfer to the designated account, etc. |

Financing

Financing B-Reproduction

B-Reproduction Subsidy,Grant

Subsidy,Grant Advance

Advance